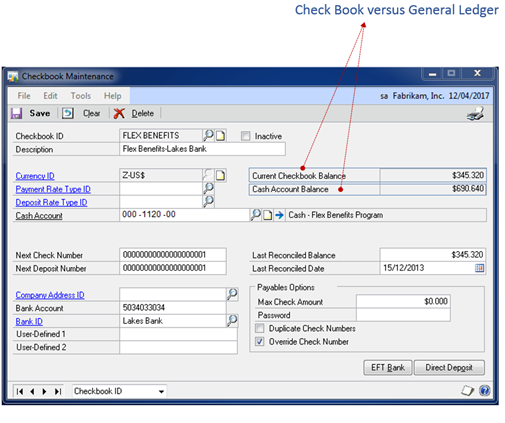

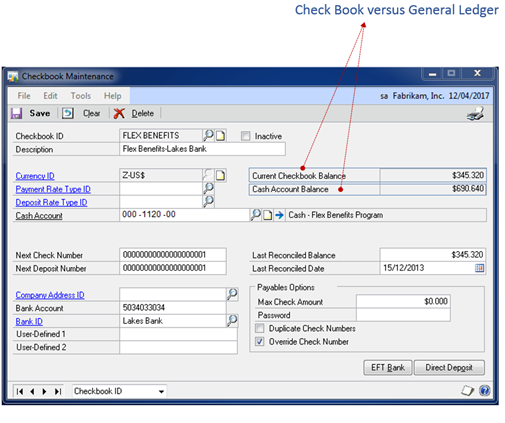

One of the common cases encountered quite often with GP users is an unbalanced checkbook versus General Ledger. As shown below in, the check book current balance is not tied to General Ledger Balance. In this post, one of the common root causes for this case is proposed and a solution criteria is explained.

Common Mistakes of Bank Transaction Entry

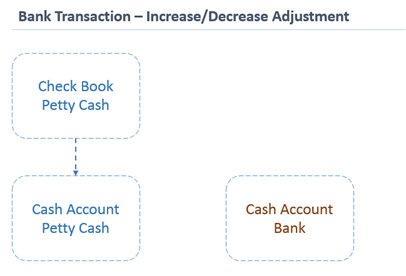

Although it is a common sense, but most GP Users fall in the trap of using Bank Transaction Entry to record an increase or decrease adjustment for the sake of a another check book which is apparently a bank transfer !

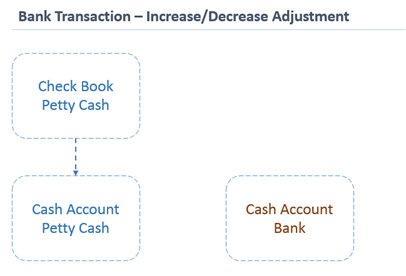

The user enters Bank Transaction Entry (either to increase or decrease adjustment on a certain check book). A common mistake is represented with choosing a “Cash Account” on the other distribution line.

The result is correct GL balance but “incorrect” check book current balance as shown below.

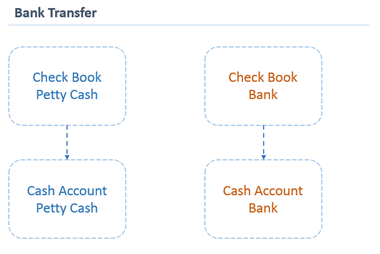

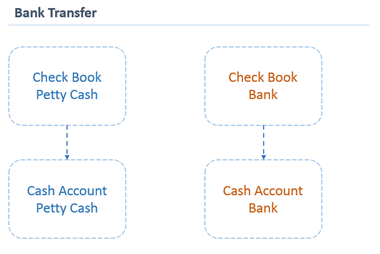

Apparently, the user meant to enter a Bank Transfer to transfer an amount of money between two checkbooks (on the Bank Module Level) and their corresponding Cash Accounts (on the General Ledger Level). See illustration below;

Solution Criteria

1- Go to Smart List > Financial > Account Transaction. Filter on the specific “Cash Account” of the unbalanced check book.

2-Go to Smart List > Financial > Bank Transactions. Filter on the specific unbalanced “Check Book”.

3- As you match both of the reports above, you will find journal entries on the account transactions that don’t have corresponding CM Transactions in the Bank Transactions report.

4- These are “Bank Transactions” that should have been recorded as “Bank Transfers”. Go to Transactions > Financial > Bank Transaction > Void Transaction. To void the incorrect CM Transactions.

5- Re-enter correct Bank Transfers to affect both check book and cash account balances.

The result is a check book tied to general ledger with no variance at all.

Recommendation

Unlike vendors and customers, check book setup is recommended to have a single cash account for every single check book. In other words, one to one relationship between CM and GL.

This will enhance the level of control over check book balances, and easy reconciliation with GL and above all your bank statement.

Best Regards,

Mahmoud M. AlSaadi

>> For running total , create the view below and proceed with the next step on the

>> For running total , create the view below and proceed with the next step on the