It is taken for granted that an international system; any system, should provide the company with broad functionalities to automate their daily transactions as derived from the international standards. For that, I find the payment document checks automation is a complex and yet ambiguous area to be covered.

>>Throughout the article, PDC abbreviation will be used to refer to the “post-dated-checks”

I have been previously working on such a project related to PDC (post dated checks) specifically for sales. The reason was simply a “Fraud incident” of thousands of dollars for a big retail company that processes 100+ post dated checks on a daily bases. The concerns were primarily represented in few questions; what are the accounting standards as relating to PDC, the legal references and the reflection of the previous on the system automation.

It was quite essential to start a basic research about the post dated checks topic in general, in order to conclude how the international standard regulate this process. What was quite difficult is to separate among the legal, accounting and system perspectives of this complicated topic.

In this essence, I am writing down my conclusion about post dated checks including my own perspective of this complex topic, supported with references either from international standards and commercial codes.

Accounting Perspective

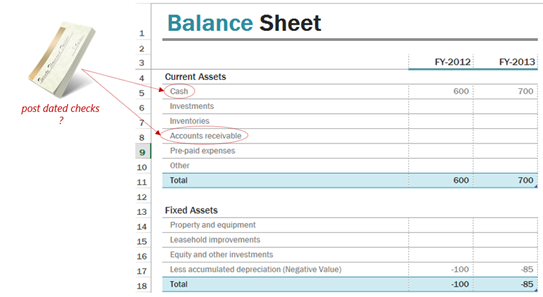

The critical question is whether to consider the PDC as cash or account receivable, this will have further implications on both the financial reporting and bookkeeping. Furthermore, and most importantly (when considering PDC for sales), the customer credit limit. If all these implications are not properly managed, it may lead to potential fraud incidents.

The generally accepted accounting principles (GAAP) considers the post dated check as a “promise to pay”. This means, the PDC should be classified as account receivables rather than cash until the due date stated on the check. In other words, there should not be any journal entry recorded to clear the account receivables and debit the cash.

Lets translate the above concept into simple accounting entries that should be recorded accordingly starting from issuing the check until it having it finally settled in the bank account.

>> Remember, this article is considering the (sales – post dated checks)

When the check is issued, there should be two dates which are practically the check date and due date, at this time, the following accounting entry should be recorded:

Account Debit Credit

Checks (Clearing Account) X --

Accounts Receivable -- X

When the check is to be settled on its due date, the cash balance should increase with the same amount:

Account Debit Credit

Cash Account X --

Checks (Clearing Account) -- X

The entries illustrated above are straightforward and clearly reflect the accounting principle which stats that the post dated check is not “cash”, while it is a promise to pay and should be recorded as account receivable.

Meanwhile, lets get one more factor into our consideration, which is the customer credit limit. In definition, a customer credit limit is “the amount of credit that a financial institution extends to a client. Credit limit also refers to the maximum amount a credit card company will allow someone to borrow on a single card. Credit limits are usually determined based on information contained in the application of the person seeking credit, or that person's credit rating.” according to Investopedia, Credit limit definition

Regardless of how you set a specific credit limit for a specific client; which usually considers various methodologies to reach a fair, reasonable and yet appropriate limit between the business and each of their clients, the credit limit is the ultimate balance that a client is allowed to reach, any dollar amount above the credit limit could be considered as a risk that a business is taking.

In this essence, and in the light of the principles and straightforward standards mentioned above, how a post dated check should relate to customer’s credit limit ?

Apparently, when the post dated check is issued, the amount paid by the client is still categorized under the accounts receivable, not cash category. Until the due date, at which the check is finally settled right ? Lets take a practical and yet simple example to make things crystal clear

PDC Case Study:

Suppose you are a central distributer of confectionary goods, selling primarily retail stores who in turn sell your products to the consumers. A specific retail client credit limit is $10,000 and has an open balance of $6000 (as of 1st of January, 2015)

At the 15th of Jan, the client has paid by check (post dated) an amount of $6000, to be collected after one month from the issuance (due date is 15th of February). At the 1st of February, the client placed an order for $5000. Should this order be fulfilled and shipped to the customer ? or rejected since it exceeds the credit limit ?

The customer credit limit is 10,000. The open balance is $6000 and the PDC amount is $6000. According to the consideration mentioned above, this order should be rejected as it exceeds the credit limit with $ 1000. The client can place an order for only $ 4000 until the PDC amount is settled which will clear both their balance and their credit limit.

Practically, the check amount represents AR, which means that the customer balance is “$ 6000”, they can order up to $ 4000 as long as they order prior to the due date of the check. (Special cases of cashing the post dated check will be explained further under the legal section of this series).

The question remains, should the customer balance be 0 after the post dated check ? or it should remain as $6000 until the cash amount is settled. If it the customer balance is correct to be zero , what is the allowed invoices for the client at this moment ? Should it be only $ 4000 or it should be $ 6000 .

>> To be continued …

Best Regards,

Mahmoud M. AlSaadi

BE SMART AND BECOME RICH IN LESS THAN 3DAYS....It all depends on how fast

ReplyDeleteyou can be to get the new PROGRAMMED blank ATM card that is capable of

hacking into any ATM machine,anywhere in the world. I got to know about

this BLANK ATM CARD when I was searching for job online about a month

ago..It has really changed my life for good and now I can say I'm rich and

I can never be poor again. The least money I get in a day with it is about

$50,000.(fifty thousand USD) Every now and then I keeping pumping money

into my account. Though is illegal,there is no risk of being caught

,because it has been programmed in such a way that it is not traceable,it

also has a technique that makes it impossible for the CCTVs to detect

you..For details on how to get yours today, email the hackers on : (

atmmachinehackers1@gmail.com ). Tell your

loved once too, and start to live large. That's the simple testimony of how

my life changed for good...Love you all ...the email address again is ;

atmmachinehackers1@gmail.com